Once again, the federal government is increasing the Canada Child Benefit (CCB) to keep pace with the increased cost of living.

The maximum amount for a child under 6 increases to $6,639 per year, and $5,602 for children over 6 until they reach age 18. These payments (and their provincial level equivalents) are income-tested payments, and as such are reduced by any household income earned and reported annually on an income tax return. The reduction could be as much as 31%, depending on total household income and the number of children.

Though many personal injury plaintiffs do not have high household earnings, even a small reduction in the CCB could have a big impact on their families.

For individuals who settle their personal injury claims, why allow income earned on your settlement to reduce your ability to provide for your family?

A structured settlement can protect your CCB from any reduction.

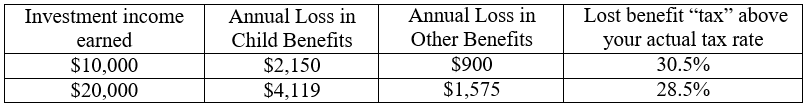

Take the example of an Ontario couple with two children aged 8 and 12, who have combined taxable income of $40,000.00. The increases for 2019 means they will receive $432.12 more in Canada and Ontario Child Benefits than they did in 2018. The table below outlines the impact of income earned from settlement dollars on their entitlement to these and other benefits.

As you can see, a personal injury settlement that is invested conventionally and earns income, could significantly reduce entitlement to various government benefits worth up to thousands of dollars per year.

Not only are structured settlement payments tax free, they are not included in income at all. No matter the amount of the structured settlement payment, it will never decrease your entitlement to income tested benefits.

Your settlement dollars are meant to protect your needs, not reduce your ability to care for your family.